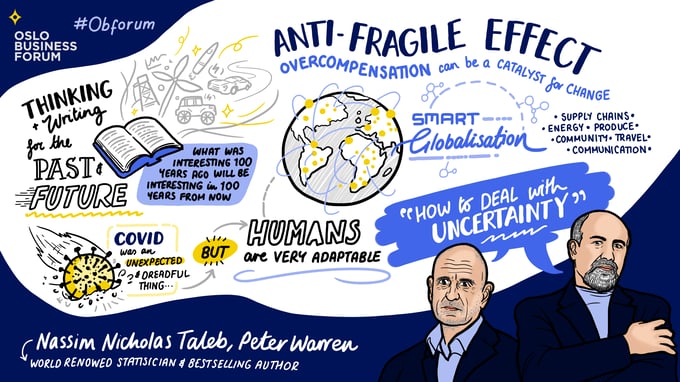

At Oslo Business Forum, Nassim Taleb sat down with moderator Peter Warren, a veteran fund manager, to talk about uncertainty in today’s business environment and share lessons leaders can learn from. Those familiar with Nassim’s work would recognize in the conversation many themes and theories from his most notable writings.

Nassim Taleb is a world-renowned statistician, trader, and author whose primary research and experience lie in randomness, probability, and uncertainty. He spent 21 years as a quantitative trader before becoming a world-famous researcher in philosophical, mathematical, and practical problems with probability. He is widely acknowledged as the best-selling author of a multivolume essay, the Incerto, covering broad facets of uncertainty.

Influenced by Finance

For much of his career, Nassim identified as a finance practitioner, hedge fund manager, and a derivatives trader. Peter began the conversation by asking Nassim how he defines himself today, having evolved from a financial expert to an academic. Nassim recounted his experience as an options trader, recalling the foundation it built for his future research. One of his greatest takeaways from trading is the concentrated view he gained of systems, which he has applied to his many theories.

Nassim believes that certain structures are built to withstand—and even thrive in—environments that are uncertain or fraught with volatility. Other environments are not. Through his experience and his studies, he has concluded that over-manipulation or deviation too far from the natural state of things often leads to less resilience.

“What it all boils down to is how some systems like volatility and others don’t, how some environments can sustain large shocks, and others don’t.”

Nassim and Peter dove deeper into these ideas in the context of current global events.

Systems and Antifragility

In their discussion, Nassim and Peter explored events ranging from COVID-19 and the shockwaves it sent through supply chains to the war between Russia and Ukraine and its impact on the global economy.

Nassim drew parallels between the systems we have built and the dynamics in our current environment that are shaking them. He spoke on his concept of antifragility, which claims that some things benefit from shocks and thrive when exposed to volatility, randomness, disorder, and stressors. They are the opposite of fragile; they are antifragile.

Nassim believes that a system or structure that is antifragile is beyond resilient, able to not only resist uncertainty but get better in uncertainty. While the discussion during the Forum just scratched the surface, Nassim covers in depth in his books how fragility can be detected, measured, and transformed to withstand difficult-to-predict events.

The Lindy Effect

In light of his successful pivot from trader to theorizer, Peter asked Nassim to share the lessons he learned on his journey to becoming a researcher and author. Nassim recalled it as a challenge but shared insights that he says are also generalizable to business.

As he approached the publication of his first book, Nassim took an unconventional approach to writing. While many authors look ahead in their work, Nassim chooses to write for the past and not the future. He believes that if you write in a way that interests the current audience and then ask yourself if it would interest an audience 30 years ago, you maximize the probability of that work being read in the future.

“It doesn’t age if you fit it for today and you fit it for the past,” Nassim said. This is an example of the Lindy Effect. The Lindy Effect is a theory that hypothesizes that the endurance of something—like an idea or technology—is proportional to its current age. The theory proposes that the longer something has survived, the longer its remaining life expectancy.

Nassim offered sage advice to business leaders, saying, “That’s a process I use for writing and also to select investments.”

Overreaction and Adaptation

As the conversation turned to current events, Peter asked Nassim to speculate on subjects that are top of mind for business leaders, including volatility and uncertainty in the global economy.

Nassim noted that, in his experience, the markets don’t know equilibrium. Rather, they go from one overreaction to another overreaction. This, however, has enabled humans to adapt quickly and, in many cases, to overcompensate for risks we perceive.

He recalled shocks in the oil industry in the 1970s and ‘80s, when we were unaware of the side effects of energy, pollution, and global warming. The swing from a period of very cheap oil to very expensive oil led global leaders to overreact. The disruption in the market heightened their awareness of the need to take action by developing energy policy. And in that action, they overcompensated.

The mechanism of overcompensation, Nassim claims, is another example of the antifragile effect that he experienced as a trader. “You overcompensate by concentrating when there is noise around you,” he said. “It is much easier to study things that are very complicated when you have money on the table.”

Overcompensation as a form of adaptation is also present in the post-pandemic environment. “Covid was horrible,” said Nassim. “But the world post-Covid is vastly more robust and less fragile.” He pointed to business leaders’ reactions to the tightening of the supply chain and how they began to diversify suppliers to strengthen their performance. This strategy, which is likely more sustainable for the future, was caused by disruption.

In Conclusion

Through his views on Vladimir Putin to his musings on Bitcoin, Nassim took the audience at Oslo Business Forum on an exploration of responses to uncertainty. Using the past to predict the future is an often relied upon strategy for business leaders, and Nassim’s theories offer a unique perspective on what lies beneath the surface of seemingly ambiguous events. The ways in which we respond to those events can sometimes strengthen our businesses for the future.

Key Points

- Certain structures are built to withstand—and even thrive in—environments that are uncertain or fraught with volatility, while other environments are not.

- Antifragility claims that some systems benefit from shocks and thrive when exposed to volatility, randomness, disorder, and stressors.

- A system that is antifragile is beyond resilient, able to not only resist uncertainty but get better in uncertainty.

- “It doesn’t age if you fit it for today and you fit it for the past.” The Lindy Effect is a theory that says the longer something has survived, the longer its remaining life expectancy.

- Markets don’t achieve equilibrium, but rather they overreact. This has enabled humans to adapt quickly and overcompensate for risks we perceive.

Questions to Consider

- In your experience as a leader, which systems or structures have you witnessed withstand disruptive events?

- How did you and your business react when faced with uncertainty in those circumstances?

- Can you recall a situation in which your business overreacted—or overcompensated—in response to a threat? Did that overcompensation strengthen your position for the future?

Want to be a part of the OBF community? Join Oslo Business Forum 2023: Thriving in Chaos now!.png?width=680&name=CTA_2023%20(2).png)