How do corporate boards work, and how should they work in this chaotic and volatile world? On 19 January, we were privileged to learn on the topic from the global economist and veteran board member, Dr. Dambisa Moyo. During our free webinar, she explained the key responsibilities of a company board, how corporate governance is changing, and also offered ways in which boards can become better equipped to confront the challenges of the 21st century.

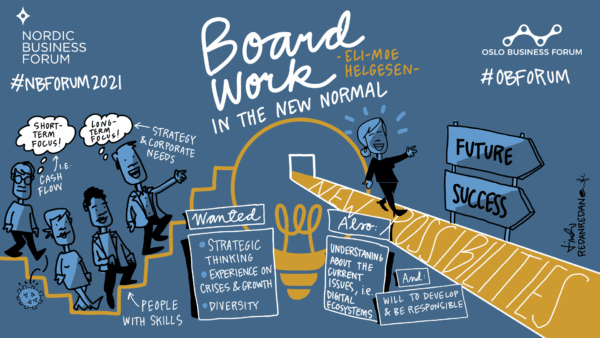

Before the session with Moyo, we had an intriguing discussion with Eli Moe-Helgesen, the National Leader Assurance from PwC. Below you can find a visual summarization of that session by Linda Saukko-Rauta.

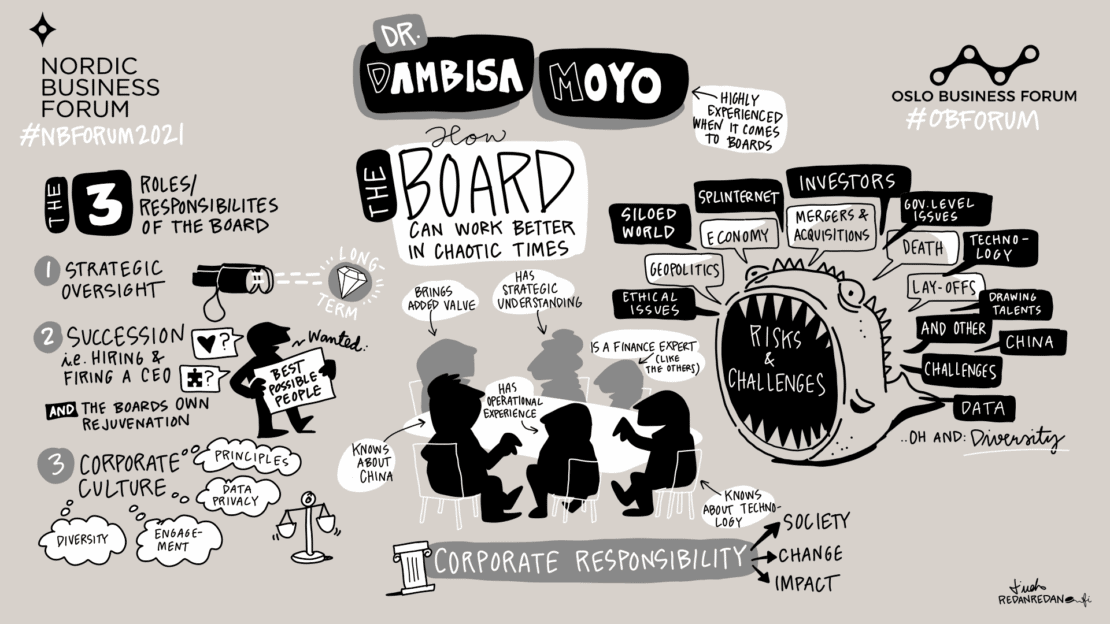

And next, we give you a brief summary of Moyo’s insights.

What are the responsibilities and the role of 21st-century corporate boards?

The question might sound a bit blunt, but according to Moyo’s expereince it appears that the role of a corporate board is a bit hazy to many. Therefore, she began by emphasizing the three mandates of a corporate board:

- Strategic oversight. “In other words, this is about what exactly is this company going to be over the long term”, Moyo elaborated. Naturally, boards can be called upon to handle sudden challenges like the pandemic or a financial crisis. But the fundamental role of a board is to consider what type of strategic decisions the company should and will take in the long run. Moyo advised, that a company board should represent the key expertise that is needed for the company to succeed. Business intelligence is important, but additionally companies also need to think what type of expertise is required in the future (e.g. digitization, new product areas, new geographical areas). Companies and their strategies change over time, and the board should always represent the expertise that the strategy demands.

- Succession. A corporate board is not only responsible for hiring and firing the CEO but also for making sure that the CEO is hiring the best talent. Related to hiring and firing the CEO, Moyo highlighted that in addition to the business intelligence of the CEO, boards are now also assessing the ethics of the person. In other words, companies should not only focus on finding a person who can maximize the financial returns, but a person that also undertands the responsibility of a company in the society at large. In this succession part lies also the fact that the rejuvenation and renewal of the board itself is also a crucial part of board work. Here too, the company should look not only for relevant business expertise and experience, but also understanding of the company’s wider role in the society.

- Culture. According to Moyo, this is the responsibility of a board that was not so important 10 years ago, but is now becoming very relevant. “Culture is basically in two buckets when the board is thinking about it”, Moyo explains. First there are the non-negotiables – the basic ways of operating for a 21st century corporation. There are things like excellence, due-diligence, respect, efficiency etc. The second bucket consists of areas of cultural frontier. “These are areas that traditionally have not been the responsibility of boards or even corporations.” Issues such as diversity and inclusion, areas of environmental concern, data privacy, etc. are now on the tables of corporate boards. Increasingly, also the wider purpose of the organization is becoming an issue for corporate boards to consider.

What are the challenges corporate boards face?

Moyo started by pointing out that the macroeconomic situation is one of the most obvious challenges boards and businesses face.

In addition, she emphasized the fact that the world is becoming more fragmented. Before, when the world was lead by the West, you could easily do business across boarders and borrow money cheaply from almost anywhere. Now, deglobalization will make things more difficult as barriers to trade and capital are restricting global operations. Company boards need to make sure that businesses can run even in a more regional world.

An issue related to deglobalization is the war for talent. Hiring the best talent from around the world will become more difficult in a more fragmented world, which will be an issue for corporate board to consider.

Moyo again raised up that today, we are moving away from the thinking “financial shareholders first”. Companies and their boards are being called upon to address issues that are not directly in their area. As she mentioned earlier that, for example, diversity, social injustice, environmental concerns, and income inequality are increasingly becoming challenges for corporate governance to deal with.

Furthermore, digitization can be one of the challenges for many companies and their boards. “How does technology actually drive returns in your business?”, Moyo suggestd you to ask yourself. Naturally, it depends on the nature of the business when it comes to how the company can deploy technology.

What are the best ways for corporate boards to navigate in the future?

Moyo mentioned that the levers corporate boards have to tackle their responsibilities and challenges are compensation and punishment. Especially with different compensation instruments, companies can incentivise people to drive the outcomes that they wish to see in the long term. She also highlighted that even though monetary compensation is the most obvious one, there are tools beyond financial benefits to incentivize stakeholders.

According to Moyo, corporate boards can navigate in the future by also focusing on the following aspects:

- Ethics committees. Boards need to look out if they should and could have ethical committees. “Some of the issues that we are dealing with are ethical issues.” So in the future, invest time and resources to think about the ethical matters your business is facing.

- Trade-offs. Moyo mentioned that there are many arrangements and compromises corporate boards need to carefully consider. For example, when it comes to replacing fossil fuels with renewable energy, you need to really think about the consequences this shift has in a larger scale.

- Diversity. It’s good to note that Moyo talks about diversity beyond gender and race, even though those are areas where there’s still a lot of work to do. “Many boards do not reflect the diversity of their customer base or employees.” Put some consideration and effort in making your board and organization truly diverse.

Bonus: What are the characteristics of a good board member?

Finally, during the Q&A session, Moyo emphasized that first of all, every board member should understand the basics of business. She underlined strategy and financial expertise especially. For example, being able to read and interpret key financial statements is crucial. “There’s no way I would put somebody on a board without financial skills.”

In addition to having the basic understanding of business operations, every person who would like to become a board member should think long an hard about what are the industries and companies that they find interesting. Also, larger corporate boards are divided into committees, so it is important to think what areas of business, i.e. which committee would be eager to serve and add value to. So, it’s also important to think about what is the expertise that you can bring to the table. “How you specifically are going to add value to the business?”