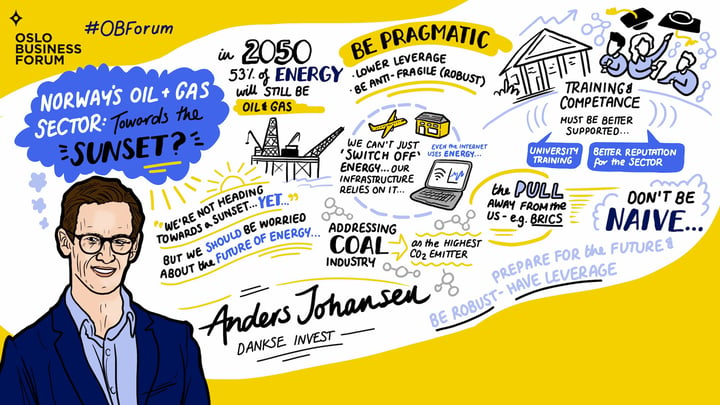

Anders Johansen is the Portfolio Manager of Norwegian Equities at Danske Invest. At Oslo Business Forum, Anders sat down to discuss the future of the oil and gas industry. He told leaders that we’re not heading towards the sunset yet—but we should be worried about the future of energy.

Climate change and technology are impacting every industry across the globe. Pressure to advance sustainability is driving businesses towards major transformation, and none more so than the oil and gas industry. Many business leaders are eager to understand: is the sector heading towards the sunset?

According to Anders Johansen, the answer is “Not yet.”

While our reliance on oil and gas isn’t imminently ending, leaders should be concerned about the future of energy. Anders explained that the demand for energy is increasing in response to population growth and other factors. At the same time, governments, institutions, and organizations are trying to shift and substitute energy sources.

“High demand and substituting 75 percent of the current energy production at the same time,” said Anders, “That is a struggle.”

“This is bad news for the planet.”

When asked if he could predict a horizon for our reliance on oil and gas, Anders pointed to the latest figures from Exxon, the largest oil producer in the world. According to their last estimate, by 2050, 53 percent of global energy production will come from oil and gas.

.jpg?width=680&height=453&name=DSCF5420%20(1).jpg)

Moderator Pellegrino Riccardi and Anders Johansen, Portfolio Manager Norwegian Equities at Danske Invest

Preparing for the Future

Leading thinkers and authorities have made an emotional appeal to business leaders, encouraging them to think future-forward. Anders agrees with these pleas but acknowledges that “It’s going to be a tough period. Changing your energy source is tough.”

Anders wants business leaders to be prepared for the challenges ahead. “We are in a period where resources have been plentiful,” he said. “The next 10 to 20 years, we will see more scarcity for energy and other resources.”

Anders believes that the organizations that can become anti-fragile stand the best chance of navigating the uncertainties ahead. The concept of antifragility claims that businesses can benefit from shocks and thrive when exposed to volatility and chaos.

“Be able to take advantage of a problematic situation,” Anders said. “If you are going through a downturn in your industry, how can you benefit from that?”

Growing Competency, Shifting Perspectives

Knowing we will continue to rely on oil and gas as far into the future as 2050, many business leaders are concerned that the next generation may not have the competence to lead the industry. The sector has faced a talent shortage for years due to an aging workforce, limited young talent, and growing competition for talent with other sectors like tech.

Anders acknowledged this as an issue and offered a solution. “We have to cooperate with universities to deliver education and evolve how people are looking at the sector,” he said.

While preparing the next generation to lead in oil and gas, Anders believes we must also raise awareness of other harmful energy sources. “We should start addressing coal consumption,” he said. “Coal is the most Co2-intensive industry.”

The Link to the Geopolitical

It is easy to see how the outlook for the oil and gas industry is linked to today’s geopolitical challenges. From Russia to China, power plays have rocked the sector and created volatility in nations worldwide.

When asked if he was optimistic about the future, Anders admitted, “I see both problems and opportunities.”

He pointed to recent developments in Saudi Arabia, which had been in close collaboration with the U.S. oil and gas sector since the 1970s. Recently, they have taken more distance, cooperating less with U.S. demands and attempts to reduce inflation. The motivation has been the ability to steer their own future. As a result, Anders said, “They are suddenly back to being able to control the oil price.”

“This is a huge development going forward and in parallel with China trying to make a power play,” he said.

Don’t Be Too Naïve

Anders was asked to leave leaders at Oslo Business Forum with advice for navigating the complex, uncertain future of energy.

“Don’t be too naïve,” he said. “This is going to be a struggle.”

He believes the years ahead will involve more complexity and volatility. It will be important for organizations to be robust, to assess their reliance on others, and to determine how to steer their own future.

Key Points

- Pressure to advance sustainability is driving businesses towards major transformation, and none more so than the oil and gas industry.

- The oil and gas sector is not heading towards the sunset yet, but we should be worried about the future of energy.

- Building competency for future industry leaders will require cooperation with universities to deliver education and an effort to evolve how people view the sector.

- The future of oil and gas will involve more complexity and volatility.

- Leaders can prepare by making their organizations robust and anti-fragile.

Questions to Consider

- How dependent is your business on oil and gas? What alternative energy sources are you exploring for the future?

- Is your outlook on our oil and gas dependency naïve or realistic? Do you feel prepared to change?

- How can your business be robust and anti-fragile? What challenges may actually be opportunities in disguise?

Want to be a part of the OBF community? Join Oslo Business Forum 2024: Courageous Leadership now!